Everything there is to know about accounts payable

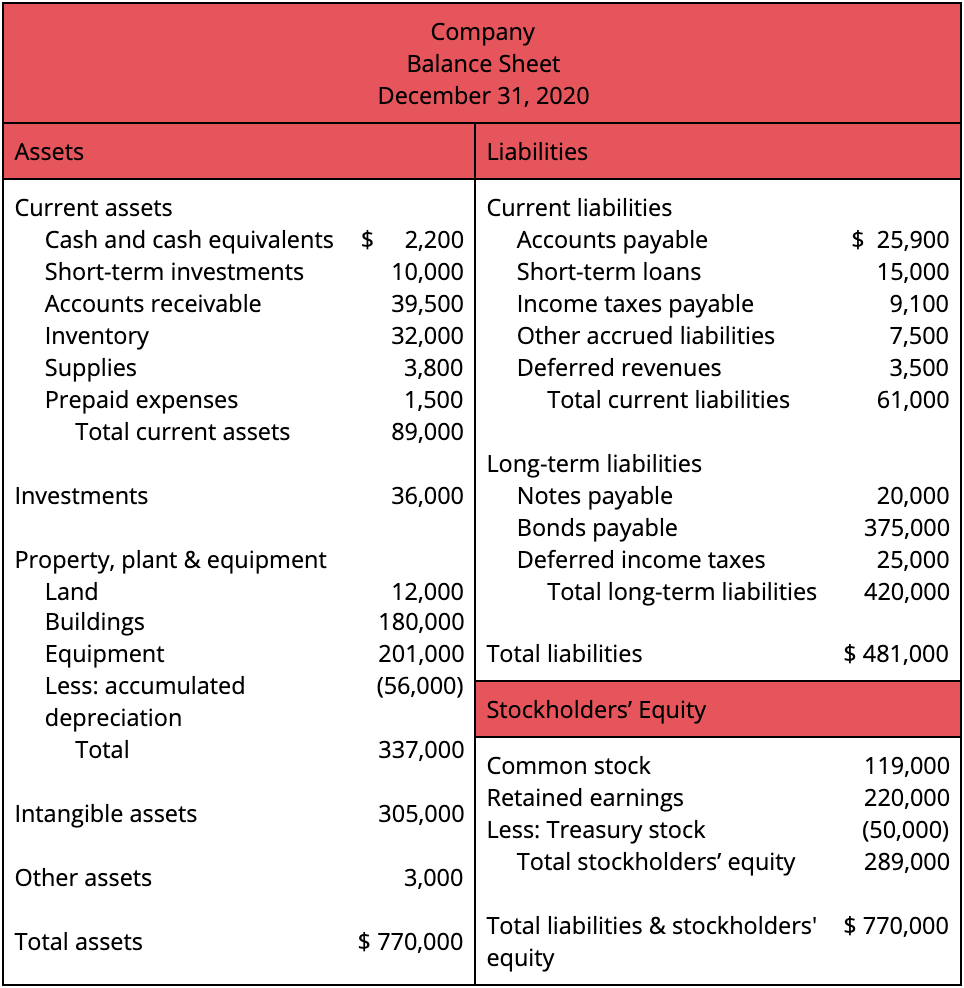

Accounts payable, recorded as AP, represents the amounts a company owes to others that are to be paid in the short-term future. It appears under the Current Liabilities section of the Balance Sheet.

Accounts payable is an accounting entry that appears on the balance sheet. It is one of the critical entries to understand the financial well-being of a business.

WHAT IS THE ACCOUNTS PAYABLE?

Accounts payable, recorded as AP, represents the amounts a company owes to others that are to be paid in the short-term future. It appears under the Current Liabilities section of the Balance Sheet. Current liabilities are short-term obligations that must be settled within a year. Among current liabilities there are also short-term loans, income taxes payable, unearned revenues, and so on.

An increase in the accounts payable from one period to the next means that the company is purchasing more goods or services on credit than it is paying off. A decrease occurs when the company settles the debts owed to suppliers more rapidly than it purchases new goods or services on credit.

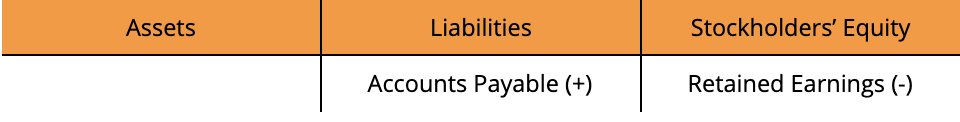

For example, let’s look at a company that hires a contractor. They purchase a service from a recruiting agency but instead of paying in cash they put it on credit, meaning they will pay for it later. This is classified as an expense and, as a result, it decreases the retained earnings account under stockholders’ equity and increases the accounts payable under liabilities.

LIABILITY VS. EXPENSE

Liabilities and expenses are not the same thing. Accounts payable is a liability because it represents obligations that the company owes. Expenses relate to the costs that the company incurs in order to generate revenue, like in the example above. Expenses are liabilities but not vice versa. As we can see from the balance sheet, accrued expenses are reported under the current liabilities section.

DEBIT OR CREDIT?

The accounting equation is: Assets = Liabilities + Stockholders’ Equity.

Debits refer to increases in the asset accounts and they are reported on the left side. Credits represent increases in the liability or stockholders’ equity accounts and are reported on the right. Since accounts payable is a liability, an increase in this account has a credit balance. Instead, a decrease would be categorized as a debit.

Let’s go back to our contractor example. The purchased service, which is an expense, reduces stockholders’ equity and therefore is classified as a debit. On the other hand, the accounts payable which increases the liabilities account is considered a credit.

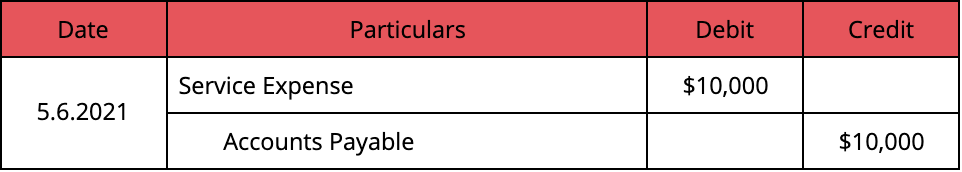

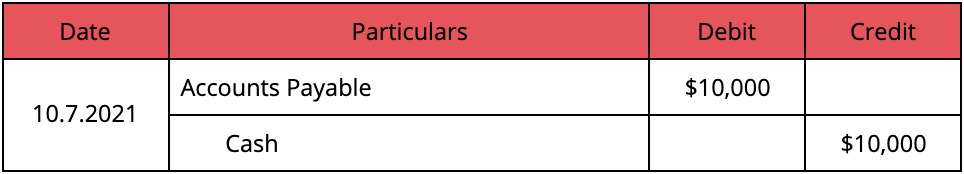

If we were to create a journal entry for this transaction it would look like this:

We would debit the service expense account and credit the accounts payable. Then, once the company pays back the supplier in cash, we would need to create another journal entry. Here we would debit the accounts payable and credit cash.

WHAT IS AN ACCOUNTS PAYABLE TURNOVER RATIO?

The accounts payable turnover ratio is a metric used to evaluate how effectively the company is paying back its suppliers. In other words, how many times does the company pay them over a specified period.

The accounts payable turnover formula is:

Accounts Payable Turnover = Cost of Goods Sold / Average Accounts Payable

If the accounts payable turnover ratio is high, it means that the company is fairly quick in paying suppliers. To find out how many days the company takes, on average, to pay its suppliers, we can calculate the average number of days payables are outstanding.

Days Payable Outstanding (DPO) = 365 Days / Accounts Payable Turnover

WHAT IS THE DIFFERENCE BETWEEN ACCOUNTS PAYABLE AND NOTES PAYABLE?

Accounts payable is different from notes payable. Accounts payable consist of purchases of goods and services on credit without a formal written contract. They are debts owed to suppliers from trade. They fall under the current liabilities category because they should be settled within one year.

On the other hand, notes payable represents the amounts of cash borrowed through a formal written contract. They are owed to lenders, such as banks, from loans. Notes payable is a long-term liability, meaning that it contains debts that can be paid back over a longer period of time.

CONCLUSION

Accounts payable is a financial term for an accounting entry that represents a company’s debt obligations to others and that must be repaid in the short-term.

Accounts payable is a current liability. We use the accounts payable turnover ratio or days payable outstanding to better understand how the company is managing its short-term debts.