Over $1 Billion in SME financing to date

PRODUCTS

PRODUCTS

PRODUCTS

A choice of products for your financial growth

Invoice Financing

Fast, flexible financing to cover any short term working capital needs

Invoice Financing

Fast, flexible financing to cover any short term working capital needs

Invoice Financing

Fast, flexible financing to cover any short term working capital needs

Term Loan

Flexible longer-term facility, repaid monthly.

Term Loan

Flexible longer-term facility, repaid monthly.

Term Loan

Flexible longer-term facility, repaid monthly.

Credit Line

Flexible longer term financing product that’s secured against your receivables

Credit Line

Flexible longer term financing product that’s secured against your receivables

Credit Line

Flexible longer term financing product that’s secured against your receivables

Revenue Share

Turn your monthly revenues into cash today, not tomorrow.

Revenue Share

Turn your monthly revenues into cash today, not tomorrow.

Revenue Share

Turn your monthly revenues into cash today, not tomorrow.

Wage Layer

Simplify global staff payroll. Protect staff from late payments.

Wage Layer

Simplify global staff payroll. Protect staff from late payments.

Wage Layer

Simplify global staff payroll. Protect staff from late payments.

ZetlBooks

Stay in control with seamless accounting & financing to manage cash flow

ZetlBooks

Stay in control with seamless accounting & financing to manage cash flow

ZetlBooks

Stay in control with seamless accounting & financing to manage cash flow

How it works

How it works

How it works

How our process ensures a seamless financing experience

01

Create an account

Simply enter your basic company info or synch with one of our integrations.

01

Create an account

Simply enter your basic company info or synch with one of our integrations.

01

Create an account

Simply enter your basic company info or synch with one of our integrations.

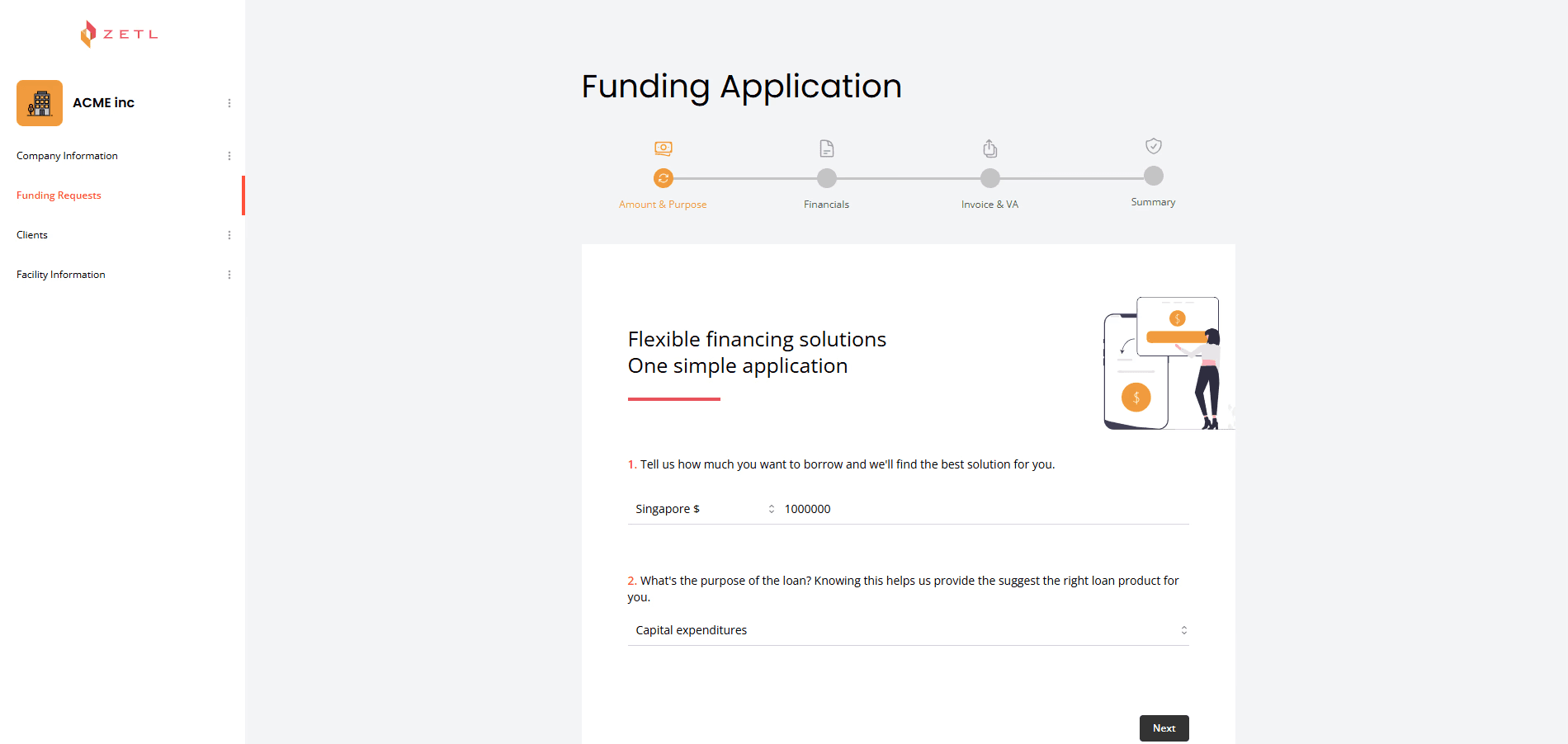

02

Request Funds

Tell us how much you financing you require.

02

Request Funds

Tell us how much you financing you require.

02

Request Funds

Tell us how much you financing you require.

03

Unlock Funds

Complete onboarding, agreements and receive approved financing to your business bank account in hours.

03

Unlock Funds

Complete onboarding, agreements and receive approved financing to your business bank account in hours.

03

Unlock Funds

Complete onboarding, agreements and receive approved financing to your business bank account in hours.

Faq's

Faq's

Faq's

Got questions? We have answers

How much will it cost?

What documentation is required and how long does the application take?

Do we have to subscribe to ZetlBooks to access financing?

What if my clients don’t pay on time?

Are there limitations to what I can use the funds for?

The financing cost seems expensive, why is this?

How much will it cost?

What documentation is required and how long does the application take?

Do we have to subscribe to ZetlBooks to access financing?

What if my clients don’t pay on time?

Are there limitations to what I can use the funds for?

The financing cost seems expensive, why is this?

How much will it cost?

What documentation is required and how long does the application take?

Do we have to subscribe to ZetlBooks to access financing?

What if my clients don’t pay on time?

Are there limitations to what I can use the funds for?

The financing cost seems expensive, why is this?

Your scrollable content goes here